The future of real estate is in the Long Tail (1 of 4)

“For too long we’ve been suffering the tyranny of lowest-common-denominator fare, subjected to brain-dead summer blockbusters and manufactured pop. Why? Economics. Many of our assumptions about popular taste are actually artifacts of poor supply-and-demand matching – a market response to inefficient distribution.” Wired Magazine, The Long Tail, Oct. 2004.

Sound familiar when it comes to strip malls, subdivisions and office parks, which make up a vast majority of new real estate investment?

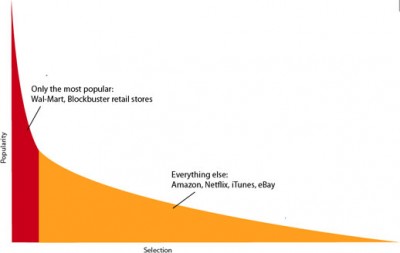

Enter The Long Tail – “the realization that the sum of many small markets is worth as much, if not more, than a few large markets.“ For instance, iTunes now has more brand recognition than Tower, Netflix forced Blockbuster to follow their business model, and Amazon is preferred over Wal-Mart by the next generation of shoppers. The graphic shows why – there is a much larger market if the ‘long tail’ (in yellow) is added – in other words, anything overlooked by the mainstream. In fact, the long tail is often larger than the ‘big head’ (orange):

“What percentage of the top 10,000 titles in any online media store (Netflix, iTunes, Amazon, or any other) will rent or sell at least once a month?” People typically guess 20%. The answer is 99%. Full story here. The ‘why’ or ‘how’ is the internet, and the reason the future of real estate is in the long tail. Part 2 tomorrow.

Speaking of daily resources, you can find one at The Long Tail blog.

Leave a Reply